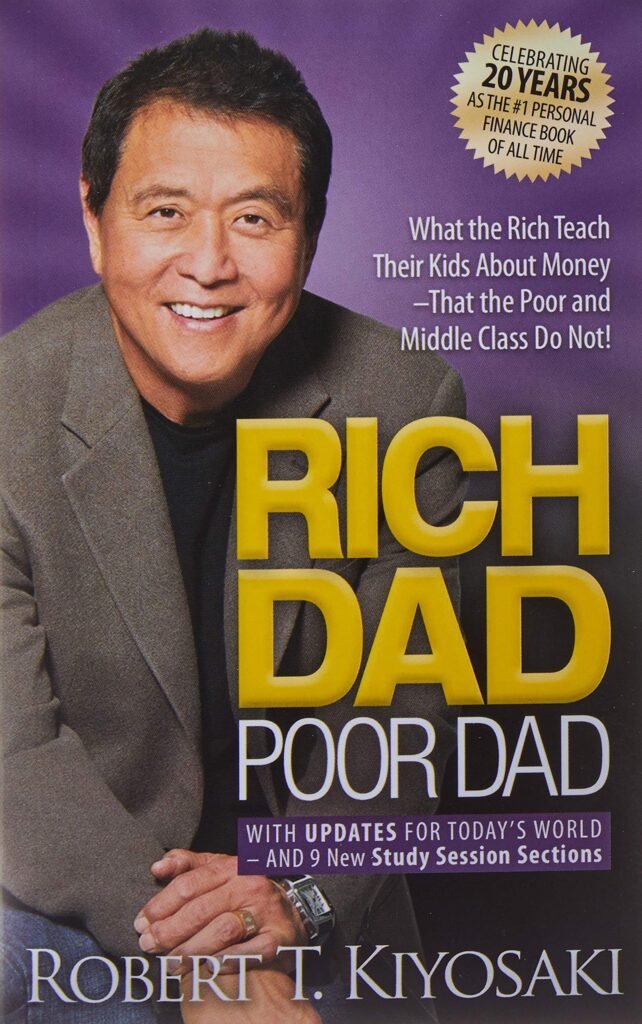

Rich Dad Poor Dad by Robert Kiyosaki has become a seminal work in the realm of personal finance. It transcends mere financial advice, offering readers a profound shift in mindset and a roadmap to financial independence. In this comprehensive exploration, we’ll delve deep into the key concepts of “Rich Dad Poor Dad” and their transformative potential in shaping your financial future.

Table of Contents

ToggleUnderstanding the Concept

“Rich Dad Poor Dad” is a personal finance classic that contrasts the financial philosophies of two father figures: the author’s biological father (Poor Dad) and the father of his best friend (Rich Dad). Through their contrasting viewpoints and life lessons, Kiyosaki illustrates fundamental principles of financial literacy and wealth creation.

check out our blog post: Unlocking the Secrets: How to Invest in the Share Market

Key Lessons from “Rich Dad Poor Dad”

- The Importance of Financial Education: Kiyosaki emphasizes the significance of financial education beyond formal schooling. Understanding concepts like assets, liabilities, cash flow, and investing is essential for achieving financial independence.

- The Difference Between Assets and Liabilities: The book highlights the distinction between assets (things that put money in your pocket) and liabilities (things that take money out of your pocket). Building a portfolio of income-generating assets is key to building wealth over time.

- The Power of Passive Income: “Rich Dad Poor Dad” advocates for the creation of passive income streams, such as rental properties, dividends from stocks, or royalties from intellectual property. Passive income provides financial freedom and allows individuals to escape the rat race of traditional employment.

- The Mindset of the Wealthy: Kiyosaki emphasizes the importance of adopting a wealthy mindset, which involves taking calculated risks, embracing failure as a learning opportunity, and continuously seeking opportunities for growth and expansion.

Applying “Rich Dad Poor Dad” Principles

- Invest in Financial Education: Take proactive steps to enhance your financial literacy by reading books, attending seminars, and seeking guidance from financial experts.

- Focus on Building Assets: Prioritize building a portfolio of income-generating assets, such as stocks, real estate, or business ventures, to create long-term wealth and financial stability.

- Diversify Your Income Streams: Explore opportunities to diversify your income sources and create multiple streams of passive income to achieve financial security and freedom.

- Adopt a Wealthy Mindset: Cultivate a mindset of abundance, resourcefulness, and resilience. Embrace challenges as opportunities for growth and never stop learning and innovating.

Conclusion

“Rich Dad Poor Dad” offers invaluable insights into the principles of financial literacy, wealth creation, and mindset mastery. By embracing the key lessons from this transformative book and applying them to your own life, you can take control of your financial future and embark on the path to true financial freedom and abundance. Start your journey towards financial empowerment today, and let “Rich Dad Poor Dad” be your guide to unlocking a brighter and wealthier tomorrow.

Frequently asked questions (FAQs) about “Rich Dad Poor Dad”

-

What is “Rich Dad Poor Dad” about?

- “Rich Dad Poor Dad” is a personal finance book written by Robert Kiyosaki. It contrasts the financial philosophies of two father figures in Kiyosaki’s life and offers valuable lessons on wealth-building, financial literacy, and mindset.

-

Who are the main characters in “Rich Dad Poor Dad”?

- The main characters are Robert Kiyosaki’s biological father (Poor Dad) and the father of his best friend (Rich Dad). Through their contrasting viewpoints and life experiences, Kiyosaki imparts essential financial principles.

-

What are some key lessons from “Rich Dad Poor Dad”?

- Some key lessons include the importance of financial education, distinguishing between assets and liabilities, harnessing the power of passive income, and cultivating a wealthy mindset.

-

Is “Rich Dad Poor Dad” suitable for beginners in personal finance?

- Yes, “Rich Dad Poor Dad” is suitable for beginners as it presents financial concepts in an accessible and easy-to-understand manner. It’s an excellent starting point for individuals looking to improve their financial literacy and mindset.

-

Does “Rich Dad Poor Dad” offer specific investment advice?

- While “Rich Dad Poor Dad” provides general principles of wealth-building and investing, it doesn’t offer specific investment advice. Instead, it encourages readers to seek financial education and make informed decisions based on their individual circumstances.

-

Has “Rich Dad Poor Dad” been successful?

- Yes, “Rich Dad Poor Dad” has been widely successful and has sold millions of copies worldwide since its publication. It has become a bestseller in the personal finance genre and has influenced countless readers in their financial journeys.

-

Are there any criticisms of “Rich Dad Poor Dad”?

- While “Rich Dad Poor Dad” has garnered praise for its valuable insights, some critics argue that certain concepts are oversimplified or lack empirical evidence. It’s essential for readers to approach the book with a critical mindset and supplement its teachings with additional research.

-

Can “Rich Dad Poor Dad” be applied to different cultures and financial contexts?

- Yes, the principles outlined in “Rich Dad Poor Dad” are applicable across various cultures and financial contexts. While specific strategies may vary depending on individual circumstances, the overarching principles of financial literacy and wealth-building are universal.

-

Is “Rich Dad Poor Dad” suitable for young readers or students?

- Yes, “Rich Dad Poor Dad” can be beneficial for young readers or students as it instills valuable financial lessons early on. It promotes a mindset of financial independence and entrepreneurship, which can be empowering for individuals of all ages.

1 thought on “Unlocking Financial Wisdom: Exploring “Rich Dad Poor Dad””